Configuration

Make the OXID eShop eVAT module operational for your OXID eShop.

Basic procedure

Activate the module.

Assign VAT rates to countries and activate countries for the specific VAT calculation.

Mark items or categories of items as electronic products or services.

Set the methods for determining the customer location.

Verify the store location.

Ensure compatibility with payment modules.

Activating eVAT

Enable OXID eShop eVAT in each subshop where you want to use the module.

Procedure

Choose .

Choose the module eVAT and choose .

Configuring eVAT

Activating and maintaining country-specific VAT rates

Activate the calculation of the VAT for the relevant countries.

Check the statically stored VAT rates and adjust them if necessary.

Attention

Maintaining VAT rates as store owner

VAT rates are already prepared for the countries of the European Union.

VAT rates are statically stored in the module, they are not automatically adjusted.

When you activate the module, it will check if there is already an entry for the country:

If yes, nothing is done.

If no, the value is taken from the list.

If the module is activated, you as a store owner have to maintain the VAT rates.

For more information, see Maintaining VAT rates.

Note

OXID eShop Enterprise Edition

In case of an Enterprise Edition, adjustments of the VAT rates affect all subhops/clients.

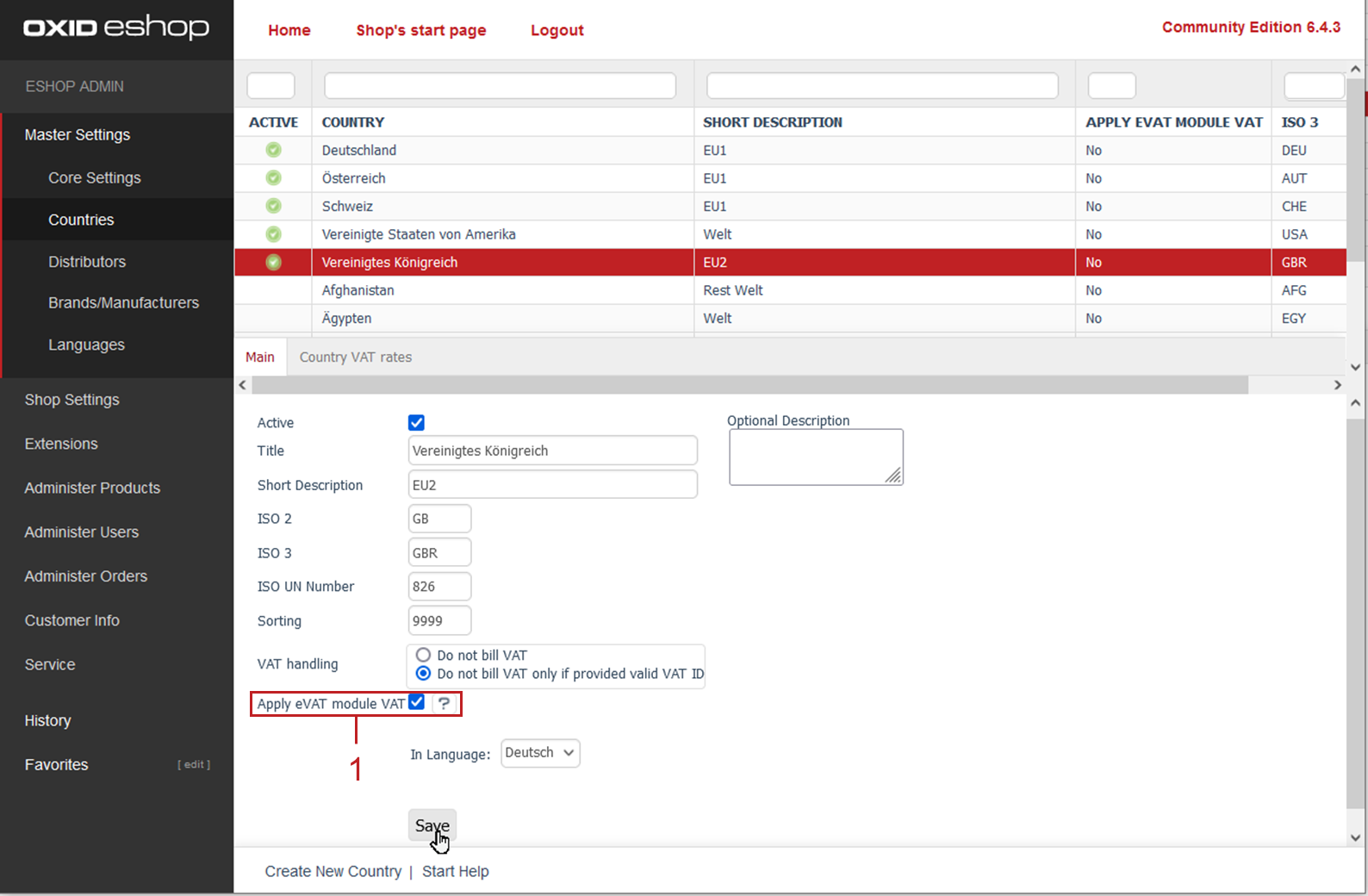

Procedure

Choose .

Choose the country to which you want to apply the EU directive and choose the Main tab.

Activate the Apply VAT module checkbox (Fig.: Applying the eVAT module VAT).

Fig.: Applying the eVAT module VAT

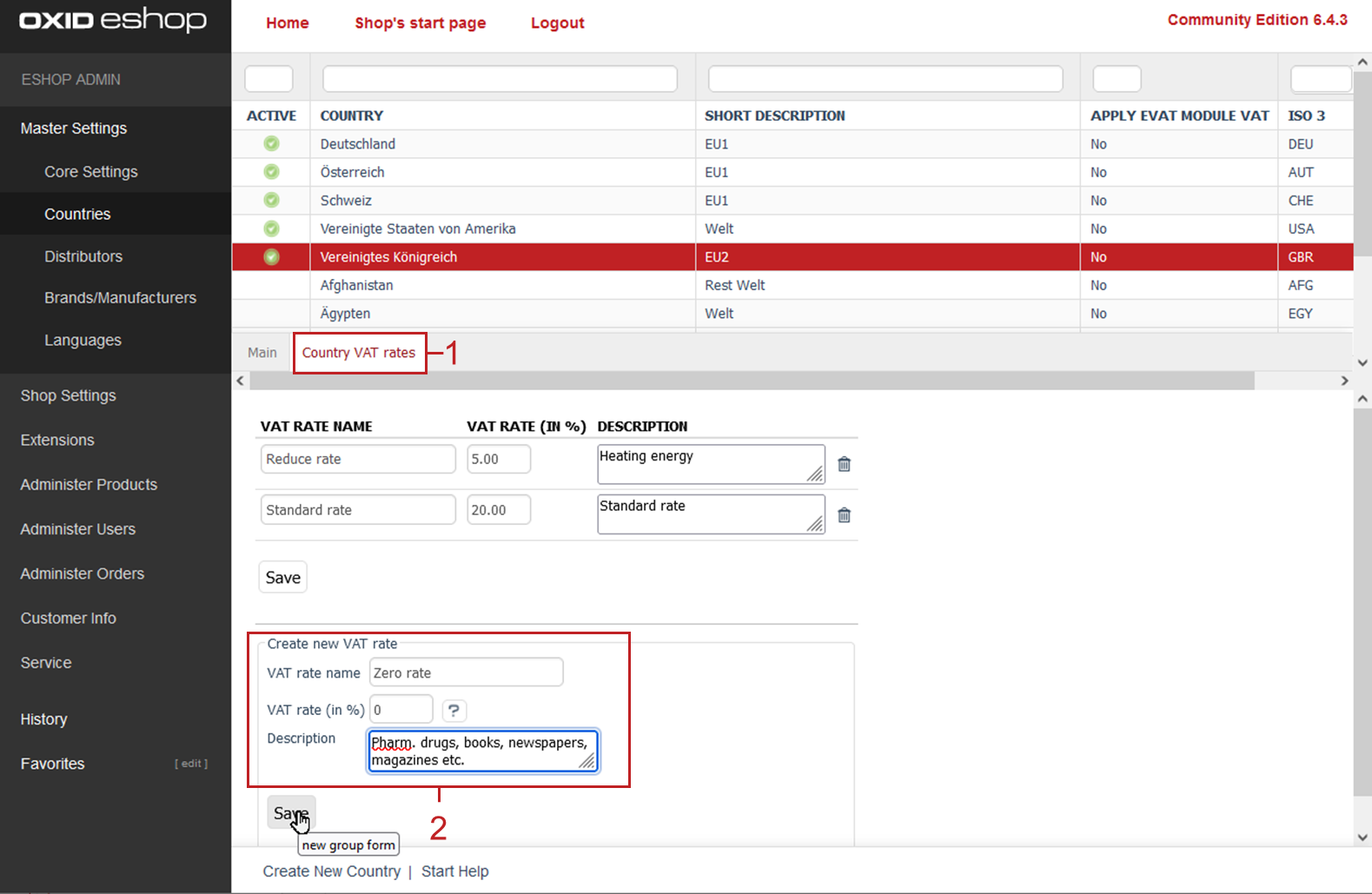

To adjust the stored VAT rates, if necessary, or to create new VAT rates, choose the Country VAT rates (Fig.: Adjusting VAT rates, example United Kingdom, pos. 1) tab.

The VAT rates for the European Union countries are already prepared.

If needed: Adjust them to the current regulations or delete them.

If needed: Create new VAT rates under Create new VAT rate, each with a name, a percentage and an optional description.

Example: For the United Kingdom, add the zero rate applicable in 2022 for, among other things, printed books and newspapers and audio books for the blind (Fig.: Adjusting VAT rates, example United Kingdom, item 2).

Fig.: Adjusting VAT rates, example United Kingdom

Save your settings.

Marking items as electronic products and assigning VAT rates

Make items that belong to telecommunication, broadcasting, television and services provided electronically identifiable as such.

Alternatively: Mark all items in a category as electronic products or services (see Marking a category as electronic products and assigning VAT rates).

Note

OXID eShop Enterprise Edition

With an Enterprise Edition you can only customize the items of the parent store. The property of an electronic product or service is inherited to the subshops.

Items or categories that you create in a subshop can be marked as electronic services separately.

Procedure

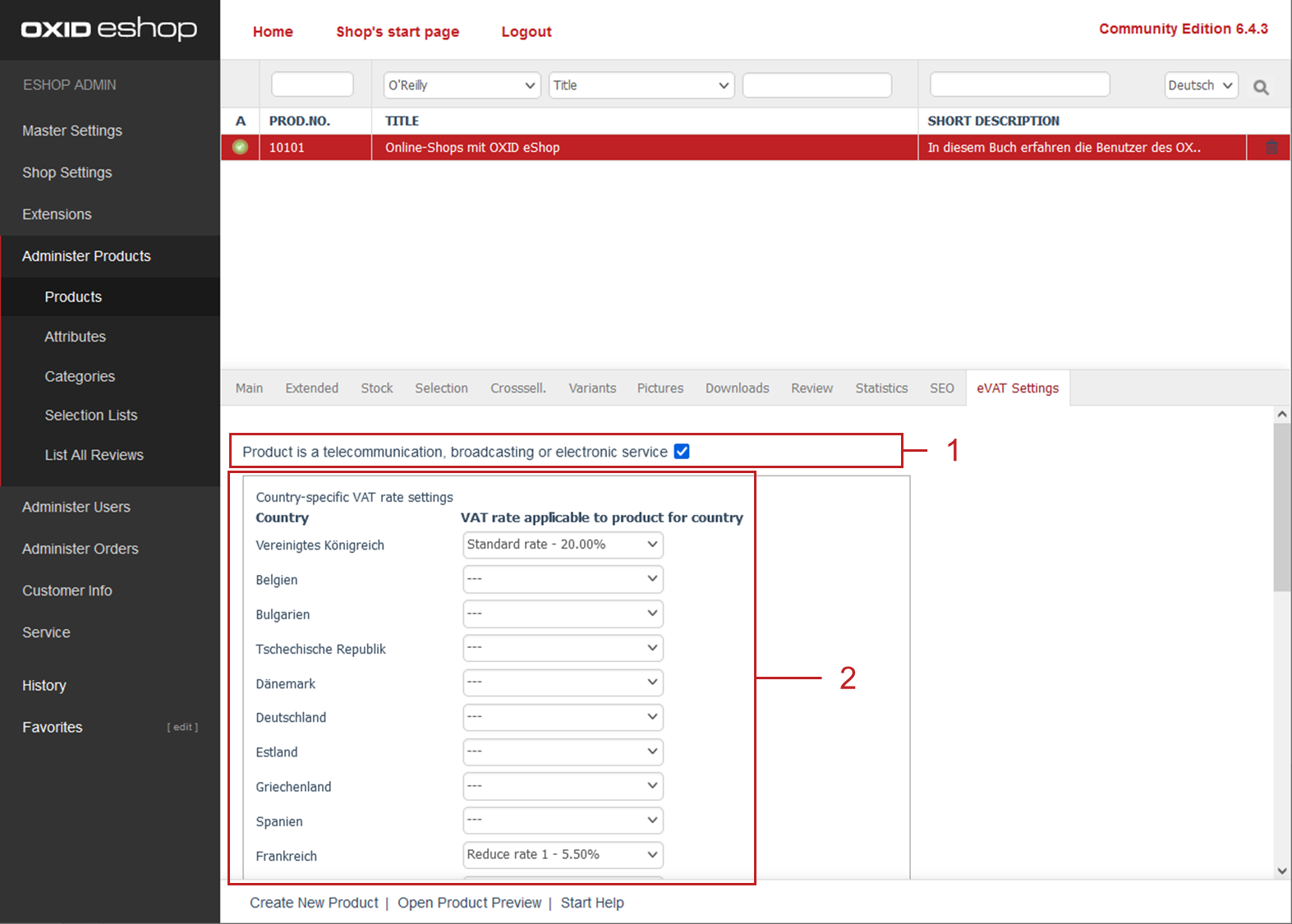

Under , choose the product.

Choose eVAT Settings tab.

Choose the Product is a telecommunication, broadcasting or electronic service checkbox (Fig.: Assigning VAT rates to an item, item 1).

Assign the applicable VAT rates for each country to the item.

For example, an eBook has the standard rate in the UK, and the reduced rate 1 in France (Fig.: Assigning VAT rates to an item, item 2).Attention

Conversion at risk.

If the VAT rate assignment for a country is missing, the customer must remove the item in question from the shopping cart.

In our example (What happens in case of error) a customer from Austria cannot buy the eBook and receives a corresponding message.

Fig.: Assigning VAT rates to an item

Marking a category as electronic products and assigning VAT rates

Mark all items in a category as electronic products or services.

Important

Overwriting item-specific eVAT settings

Changes to eVAT settings will overwrite all individual eVAT settings on all items in that category.

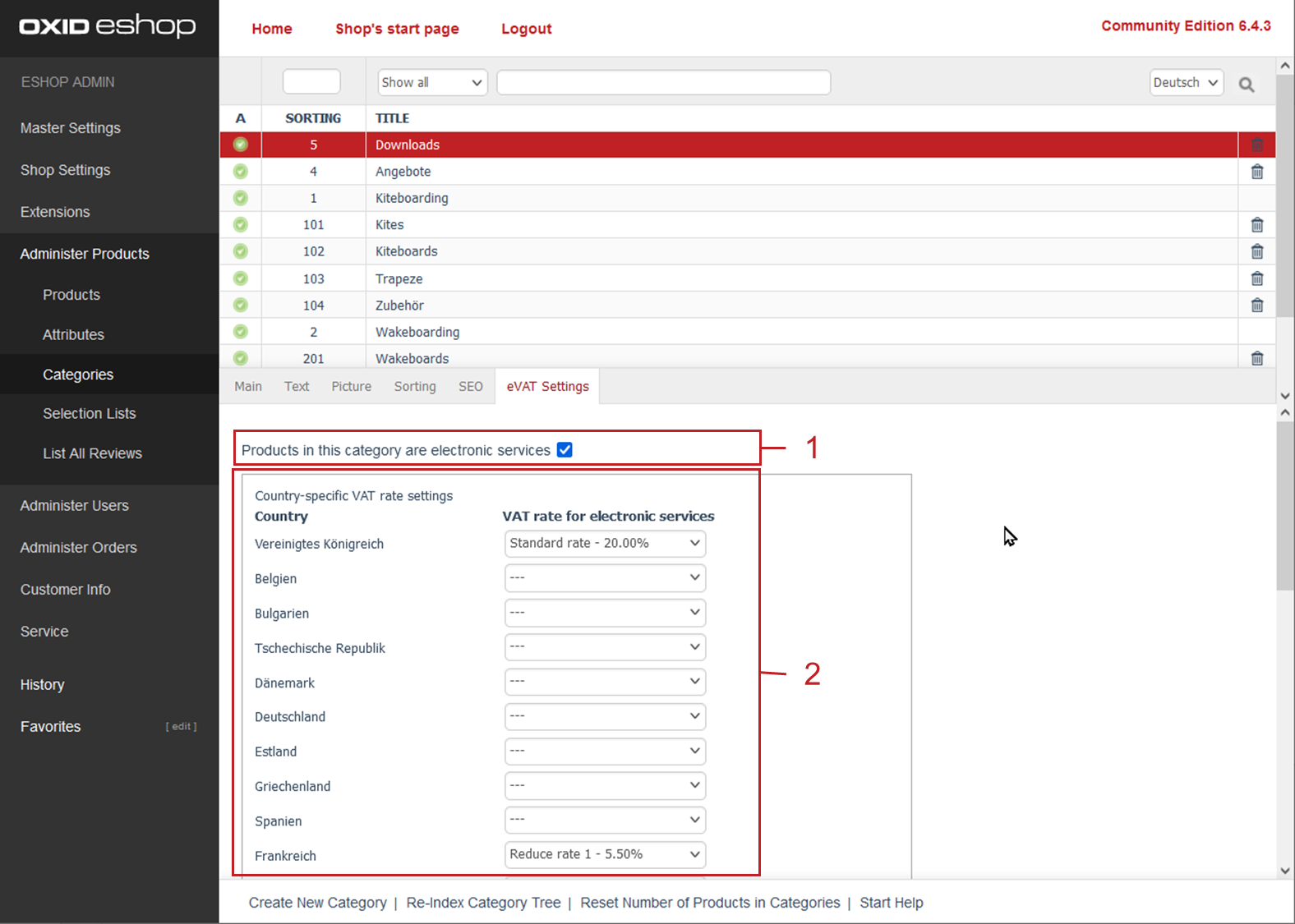

Procedure

Choose .

Choose the product category.

Choose the eVAT Settings tab.

Choose the Products in this category are electronic services checkbox (Fig.: Defining items of a category as electronic services, item 1).

Assign the valid VAT rates for each country to the item (Fig.: Defining items of a category as electronic services, item 2).

Attention

Conversion at risk.

If the VAT rate assignment for a country is missing, the customer must remove the item in question from the shopping cart.

In our example (What happens in case of error), a customer from Austria cannot buy the eBook and receives a corresponding message.

Save your settings.

Fig.: Defining items of a category as electronic services

Configuring the customer location determination

Enable determining the customer location.

Background

The Implementing Regulation (EU) No 1042/2013 requires that the country of origin of the customer ordering a telecommunications, broadcasting, television and electronically supplied service must be determined in order to correctly calculate VAT.

The customer’s location must be determined by at least two checks. Simply indicating the customer in the ordering process is not sufficient; you must verify the customer’s information.

The OXID eShop eVAT module uses the customer’s billing address to determine the customer location.

You can add custom determination methods if needed (see Adding a method to determine the customer location).

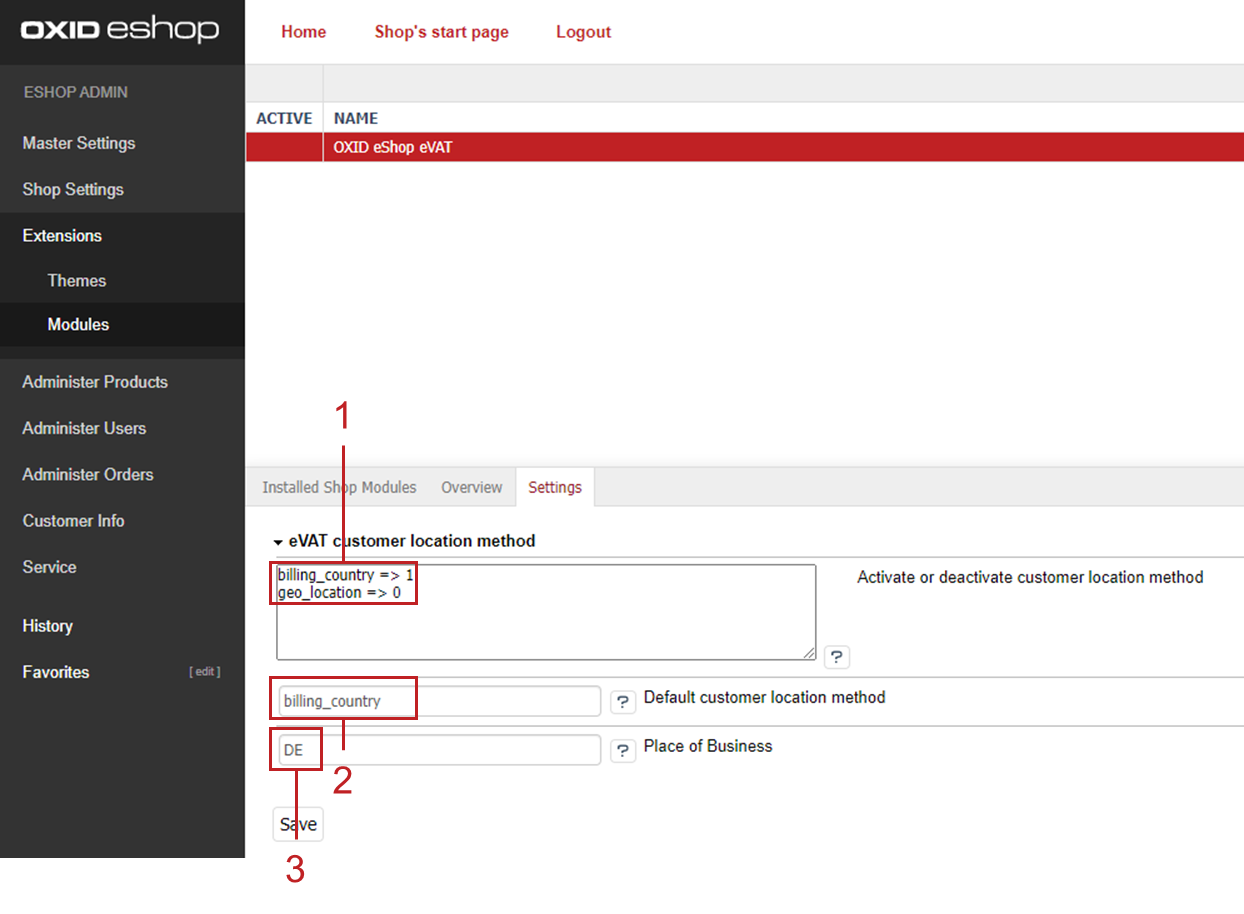

Procedure

Choose .

Choose the OXID eShop eVAT module and choose the Settings tab.

Under eVAT customer location method, make sure that the Determine customer location using billing address determination method is enabled.

To do this, do the following:Make sure that the billing_country parameter is assigned the 1 value (Fig.: Configuring the determination method, item 1).

billing_country => 1

Make sure

billing_countryis selected as the default determination method (Fig.: Configuring the determination method, item 2).

Fig.: Configuring the determination method

Note

The

geo_locationdetermination method is not implemented.Save your settings.

Result

The result of the check will be saved in the order.

In the current operation, you can check the result of determining the customer location in the order (see Displaying the customer location in an order).

Verifying the store location

Make sure that the store location is configured correctly.

Procedure

Choose .

Choose the OXID eShop eVAT module and choose the Settings tab.

In the Place of Business field, enter the country code for the store location in ISO2 format (in our example

defor Germany: Fig.: Configuring the determination method, item 3).

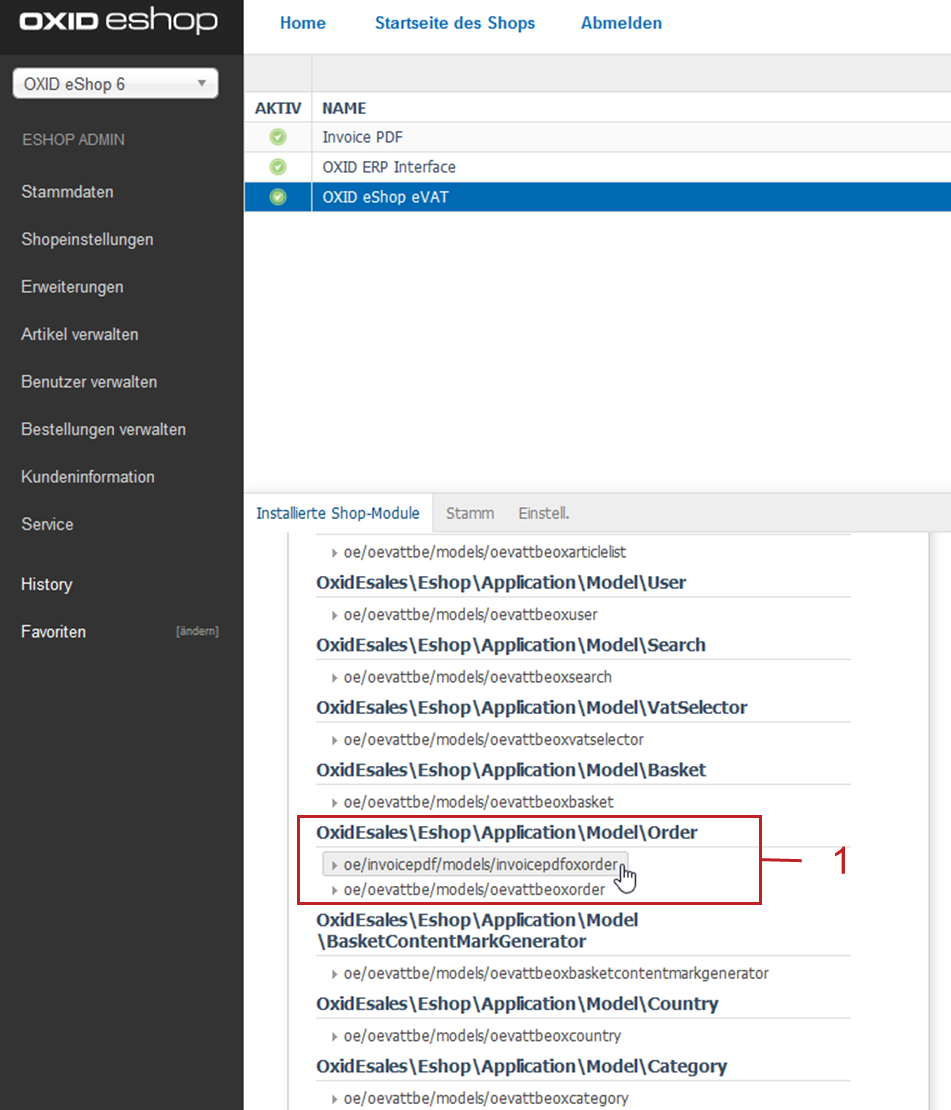

Configuring PDF Invoice

If you use PDF-Invoice (see github.com/OXIDprojects/pdf-invoice-module) in your OXID eShop, make sure that the order of the overloaded classes is correct.

Procedure

In the administration area, choose .

On the Installed store modules tab, the overloaded classes are listed.Under OxidEsalesEshopApplicationModelOrder make sure that the invoicepdfoxorder module is placed before the oevattbeoxorder module (Fig.: Ensuring the correct sequence of modules, item 1).

To do so, drag the entry to the correct position with the mouse button held down.Save your settings.

Fig.: Ensuring the correct sequence of modules

Result

You can output invoices in PDF format under .

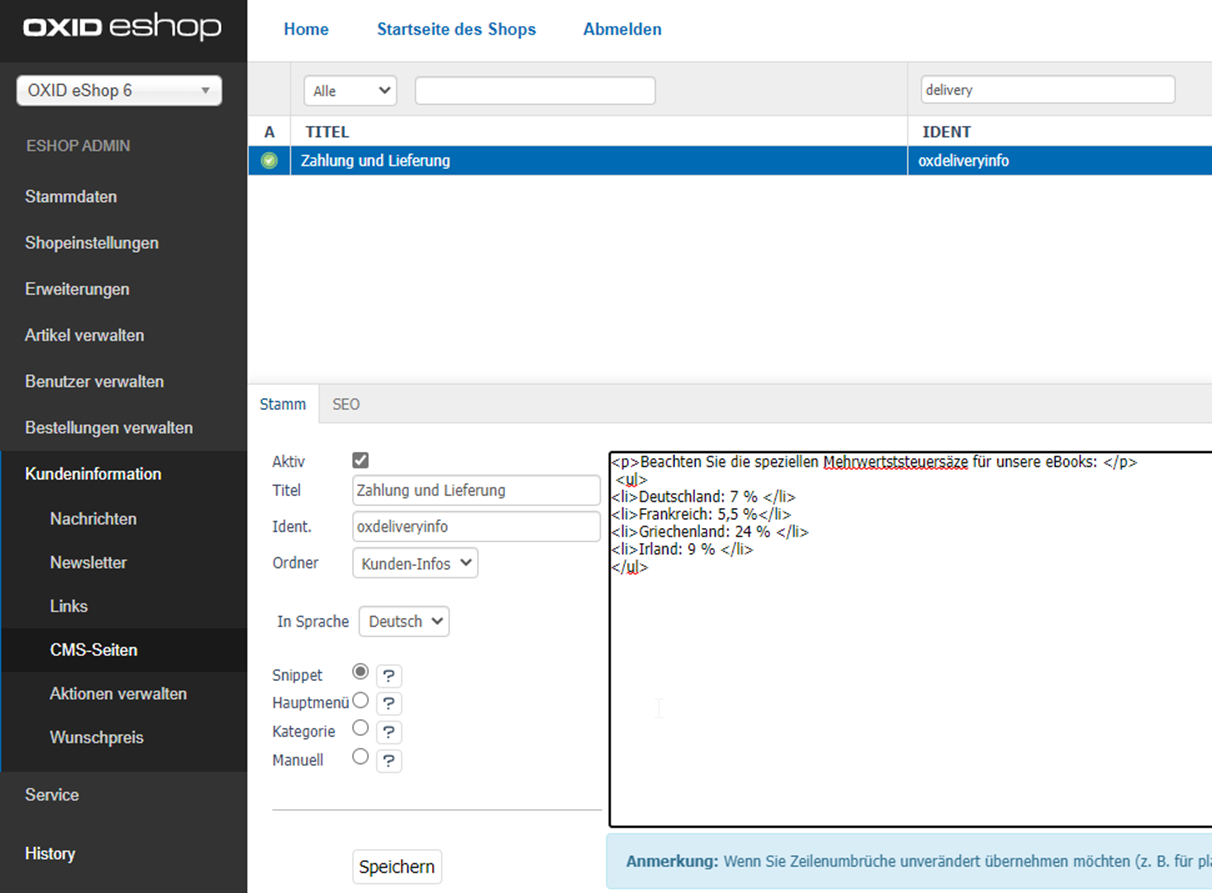

Adding customer information about VAT rates

Inform your customers about the different VAT rates.

Your customers can access this information via a link on the item detail page (see Information on value added tax from the customer’s point of view, item 2).

Procedure

In the administration area, choose .

Call the page with the ID oxdeliveryinfo.

Add information related to special items and new VAT calculation (Fig.: Adding customer information about value added tax).

Save your settings.

Fig.: Adding customer information about value added tax

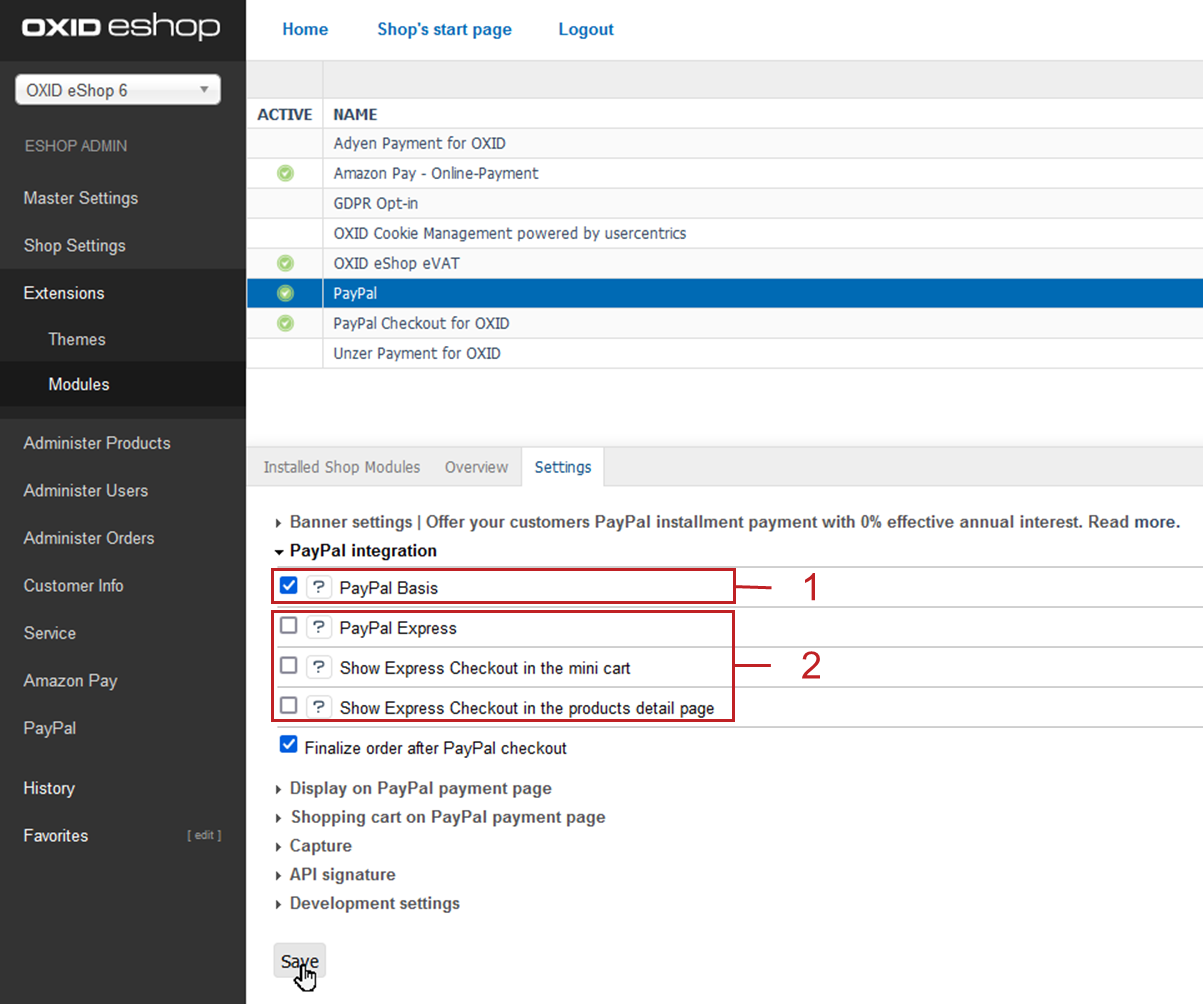

Ensuring compatibility with payment modules

If you use additional payment modules, make sure that your payment modules are compatible with OXID eShop eVAT.

To do this, check if your payment module has a quick purchase feature (Express Ccheckout) (this is the case for PayPal, for example) and turn off the quick purchase feature.

You do not need to do anything if you have

use a payment module without a quick purchase feature, for example Unzer Payment for OXID

use the OXID eShop eVAT-compatible payment modules PayPal Checkout or Amazon Pay.

Background

The PayPal Checkout, Amazon Pay and Unzer Payment for OXID payment modules are compatible with OXID eShop eVAT: Even with the quick purchase feature, your customer is taken to a checkout page where the customer confirms the order data including the VAT rate.

On the other hand, the quick purchase feature of PayPal or PayPal Plus modules is not compatible with OXID eShop eVAT.

Reason: For customers who are not registered, the final price for telecommunication, broadcasting, television and services provided electronically cannot be calculated and passed on to PayPal.

If a payment module is not compatible with OXID eShop eVAT, then your OXID eShop uses only the standard VAT determination functionality, and the VAT determined may be incorrect.

Procedure

In our following example, you will ensure compatibility for the PayPal payment module.

Choose .

Choose the payment module, in our example PayPal.

In our example, choose .

To make sure that (in our example for PayPal) only the default payment method is enabled, do the following:

Make sure that the PayPal Basis checkbox is enabled (Fig.: Disabling the quick purchase function of the PayPal module, item 1).

Make sure that the following checkboxes are disabled (Fig.: Disabling the quick purchase function of the PayPal module, item 2): * PayPal Express * Show Express Checkout in the mini cart. * Show Express Checkout in the products detail page.

Save your settings.

Result: The quick purchase feature is disabled, orders are not completed immediately by the payment processor, but the customer lands on the checkout page, and the customer has to confirm the order with the correctly determined VAT.

For more information, see your payment module documentation.If your payment module does not allow you to disable the quick purchase feature, disable the payment module for the electronic items.

Fig.: Disabling the quick purchase function of the PayPal module