Operation

Use the following functions of the OXID eShop eVAT module during operation:

Displaying the customer location in the order

Displaying the sales tax identification number

Displaying the customer location in an order

If required, verify that OXID eShop eVAT has determined the customer location.

Prerequisites

Your customer has purchased at least one item that qualifies as telecommunications, broadcasting, television, and electronically delivered service.

Procedure

Choose Administer Orders –> Orders.

Choose an order that contains an electronic item.

Result

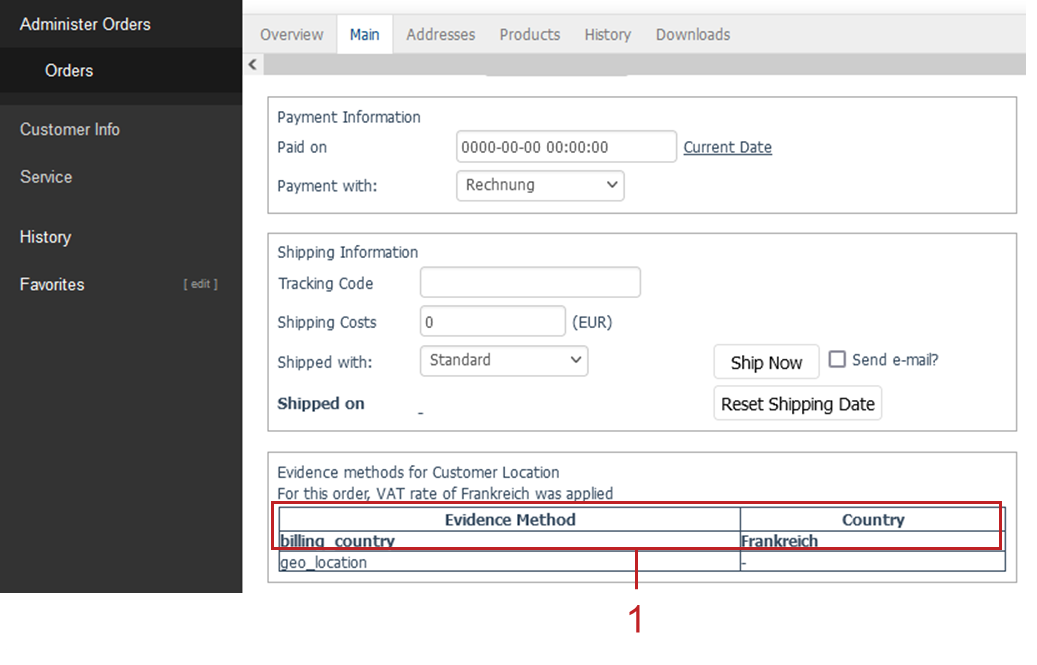

On the Main tab, below the input area, the result of determining the customer location is displayed (Figure: Displaying the customer location in an order, item 1).

Figure: Displaying the customer location in an order

Displaying the VAT ID

If required, display the customer’s VAT ID and the date and time it was saved.

The OXID eShop eVAT module ensures that the VAT number (VAT ID) entered by a customer is saved along with the date and time when it is valid.

VAT ID, date and time give you an indication that and from when the customer is considered to be liable to pay VAT to the store.

Customers can provide the VAT ID when registering or during the ordering process. They can also enter it later in their customer accounts.

Procedure

Choose .

Choose the user.

Choose the Main tab.

Result

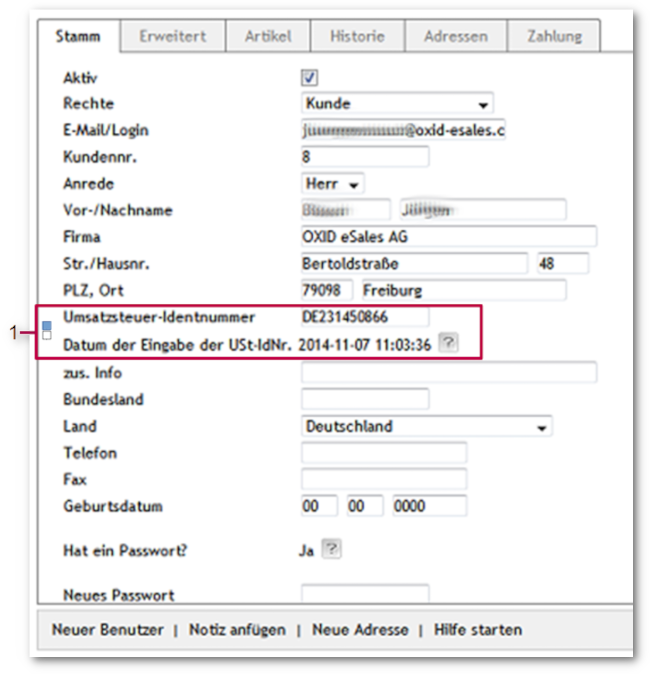

If a sales VAT ID exists, it is displayed with the date and time of entry (Fig.: Displaying VAT ID, item 1).

Fig.: Displaying VAT ID

Maintaining VAT rates

The current VAT rates of the different countries are statically stored in the module. They are not updated automatically.

Once you have enabled OXID eShop eVAT, as a store owner you need to maintain the VAT rates.

Tip

To keep up to date with possible changes in VAT rates, subscribe to an information service.

Prerequisites

When configuring OXID eShop eVAT, under you have ensured that each item in question is assigned the VAT rate valid for that country.

For more information, see

Marking items as electronic products and assigning VAT rates

Marking a category as electronic products and assigning VAT rates

Procedure

Maintain the VAT rates under .

For more information, see Activating and maintaining country-specific VAT rates